Page 9 - LN DISSOLUTION OF FIRM

P. 9

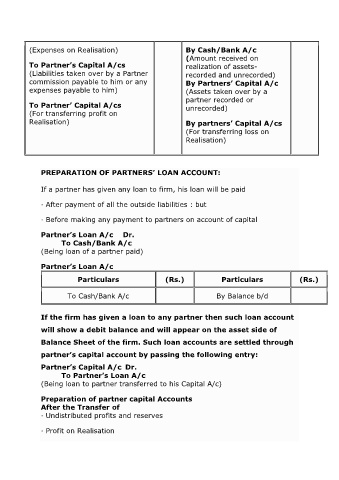

(Expenses on Realisation) By Cash/Bank A/c

(Amount received on

To Partner’s Capital A/cs realization of assets-

(Liabilities taken over by a Partner recorded and unrecorded)

commission payable to him or any By Partners’ Capital A/c

expenses payable to him) (Assets taken over by a

partner recorded or

To Partner’ Capital A/cs unrecorded)

(For transferring profit on

Realisation) By partners’ Capital A/cs

(For transferring loss on

Realisation)

PREPARATION OF PARTNERS’ LOAN ACCOUNT:

If a partner has given any loan to firm, his loan will be paid

· After payment of all the outside liabilities : but

· Before making any payment to partners on account of capital

Partner’s Loan A/c Dr.

To Cash/Bank A/c

(Being loan of a partner paid)

Partner’s Loan A/c

Particulars (Rs.) Particulars (Rs.)

To Cash/Bank A/c By Balance b/d

If the firm has given a loan to any partner then such loan account

will show a debit balance and will appear on the asset side of

Balance Sheet of the firm. Such loan accounts are settled through

partner’s capital account by passing the following entry:

Partner’s Capital A/c Dr.

To Partner’s Loan A/c

(Being loan to partner transferred to his Capital A/c)

Preparation of partner capital Accounts

After the Transfer of

· Undistributed profits and reserves

· Profit on Realisation