Page 8 - LN DISSOLUTION OF FIRM

P. 8

(Being realization expenses paid by one partner and borne by another

partner).

In case the realization expenses are borne by a partner, clear indication

should be given regarding the payment there of.

F. For Closing Realisation Account

a. When Realization A/c Discloses profit (in case total of credit side is

more than the total of debit side)

Realisation A/c Dr.

To Partner’s Capital A/cs

(Being profit on realization transferred to partners’ capital A/cs)

b. When Realisation A/c discloses loss (in case total of debit side is more

than the total of credit side)

Partners’ Capital A/c Dr.

To Realisation A/c

(Being loss on realization transferred to partners capital A/cs)

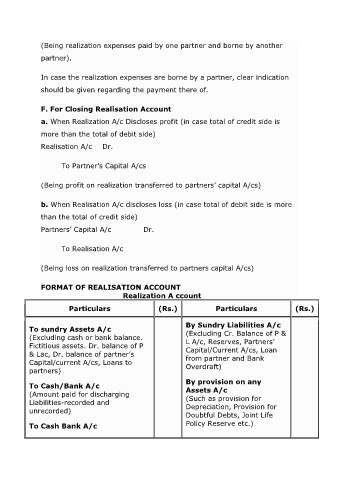

FORMAT OF REALISATION ACCOUNT

Realization A ccount

Particulars (Rs.) Particulars (Rs.)

By Sundry Liabilities A/c

To sundry Assets A/c (Excluding Cr. Balance of P &

(Excluding cash or bank balance. L A/c, Reserves, Partners’

Fictitious assets. Dr. balance of P Capital/Current A/cs, Loan

& Lac, Dr. balance of partner’s

Capital/current A/cs, Loans to from partner and Bank

Overdraft)

partners)

To Cash/Bank A/c By provision on any

Assets A/c

(Amount paid for discharging (Such as provision for

Liabilities-recorded and

unrecorded) Depreciation, Provision for

Doubtful Debts, Joint Life

To Cash Bank A/c Policy Reserve etc.)