Page 5 - LN DISSOLUTION OF FIRM

P. 5

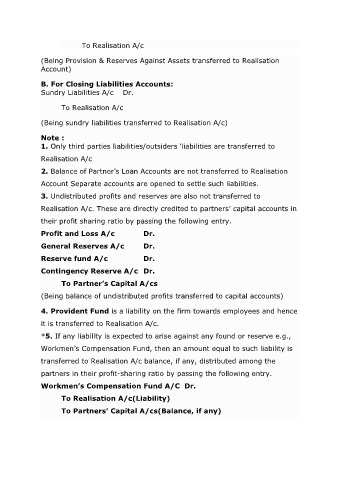

To Realisation A/c

(Being Provision & Reserves Against Assets transferred to Realisation

Account)

B. For Closing Liabilities Accounts:

Sundry Liabilities A/c Dr.

To Realisation A/c

(Being sundry liabilities transferred to Realisation A/c)

Note :

1. Only third parties liabilities/outsiders ‘liabilities are transferred to

Realisation A/c

2. Balance of Partner’s Loan Accounts are not transferred to Realisation

Account Separate accounts are opened to settle such liabilities.

3. Undistributed profits and reserves are also not transferred to

Realisation A/c. These are directly credited to partners’ capital accounts in

their profit sharing ratio by passing the following entry.

Profit and Loss A/c Dr.

General Reserves A/c Dr.

Reserve fund A/c Dr.

Contingency Reserve A/c Dr.

To Partner’s Capital A/cs

(Being balance of undistributed profits transferred to capital accounts)

4. Provident Fund is a liability on the firm towards employees and hence

it is transferred to Realisation A/c.

*5. If any liability is expected to arise against any found or reserve e.g.,

Workmen’s Compensation Fund, then an amount equal to such liability is

transferred to Realisation A/c balance, if any, distributed among the

partners in their profit-sharing ratio by passing the following entry.

Workmen’s Compensation Fund A/C Dr.

To Realisation A/c(Liability)

To Partners’ Capital A/cs(Balance, if any)