Page 4 - LN DISSOLUTION OF FIRM

P. 4

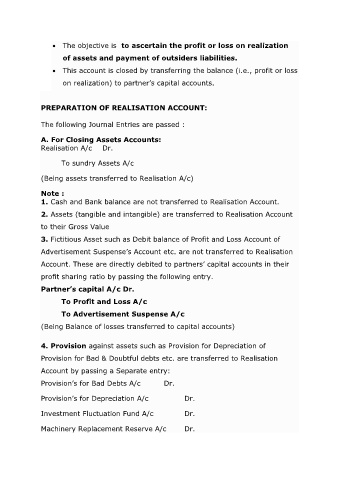

• The objective is to ascertain the profit or loss on realization

of assets and payment of outsiders liabilities.

• This account is closed by transferring the balance (i.e., profit or loss

on realization) to partner’s capital accounts.

PREPARATION OF REALISATION ACCOUNT:

The following Journal Entries are passed :

A. For Closing Assets Accounts:

Realisation A/c Dr.

To sundry Assets A/c

(Being assets transferred to Realisation A/c)

Note :

1. Cash and Bank balance are not transferred to Realisation Account.

2. Assets (tangible and intangible) are transferred to Realisation Account

to their Gross Value

3. Fictitious Asset such as Debit balance of Profit and Loss Account of

Advertisement Suspense’s Account etc. are not transferred to Realisation

Account. These are directly debited to partners’ capital accounts in their

profit sharing ratio by passing the following entry.

Partner’s capital A/c Dr.

To Profit and Loss A/c

To Advertisement Suspense A/c

(Being Balance of losses transferred to capital accounts)

4. Provision against assets such as Provision for Depreciation of

Provision for Bad & Doubtful debts etc. are transferred to Realisation

Account by passing a Separate entry:

Provision’s for Bad Debts A/c Dr.

Provision’s for Depreciation A/c Dr.

Investment Fluctuation Fund A/c Dr.

Machinery Replacement Reserve A/c Dr.