Page 8 - HA- SUBJECTIVE - Copy

P. 8

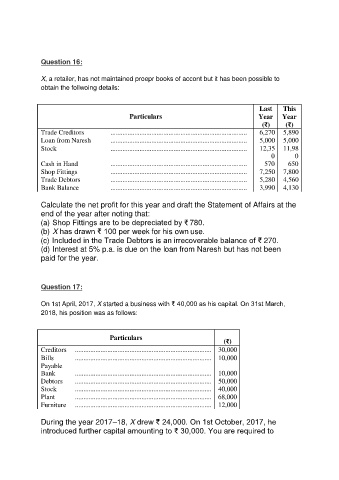

Question 16:

X, a retailer, has not maintained proepr books of accont but it has been possible to

obtain the follwoing details:

Last This

Particulars Year Year

(₹) (₹)

Trade Creditors ................................................................................ 6,270 5,890

Loan from Naresh ................................................................................ 5,000 5,000

Stock ................................................................................ 12,35 11,98

0 0

Cash in Hand ................................................................................ 570 650

Shop Fittings ................................................................................ 7,250 7,800

Trade Debtors ................................................................................ 5,280 4,560

Bank Balance ................................................................................ 3,990 4,130

Calculate the net profit for this year and draft the Statement of Affairs at the

end of the year after noting that:

(a) Shop Fittings are to be depreciated by ₹ 780.

(b) X has drawn ₹ 100 per week for his own use.

(c) Included in the Trade Debtors is an irrecoverable balance of ₹ 270.

(d) Interest at 5% p.a. is due on the loan from Naresh but has not been

paid for the year.

Question 17:

On 1st April, 2017, X started a business with ₹ 40,000 as his capital. On 31st March,

2018, his position was as follows:

Particulars

(₹)

Creditors ................................................................................ 30,000

Bills ................................................................................ 10,000

Payable

Bank ................................................................................ 10,000

Debtors ................................................................................ 50,000

Stock ................................................................................ 40,000

Plant ................................................................................ 68,000

Furniture ................................................................................ 12,000

During the year 2017–18, X drew ₹ 24,000. On 1st October, 2017, he

introduced further capital amounting to ₹ 30,000. You are required to