Page 10 - HA- SUBJECTIVE - Copy

P. 10

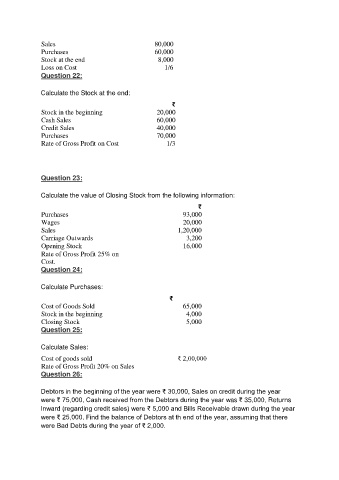

Sales 80,000

Purchases 60,000

Stock at the end 8,000

Loss on Cost 1/6

Question 22:

Calculate the Stock at the end:

₹

Stock in the beginning 20,000

Cash Sales 60,000

Credit Sales 40,000

Purchases 70,000

Rate of Gross Profit on Cost 1/3

Question 23:

Calculate the value of Closing Stock from the following information:

₹

Purchases 93,000

Wages 20,000

Sales 1,20,000

Carriage Outwards 3,200

Opening Stock 16,000

Rate of Gross Profit 25% on

Cost.

Question 24:

Calculate Purchases:

₹

Cost of Goods Sold 65,000

Stock in the beginning 4,000

Closing Stock 5,000

Question 25:

Calculate Sales:

Cost of goods sold ₹ 2,00,000

Rate of Gross Profit 20% on Sales

Question 26:

Debtors in the beginning of the year were ₹ 30,000, Sales on credit during the year

were ₹ 75,000, Cash received from the Debtors during the year was ₹ 35,000, Returns

Inward (regarding credit sales) were ₹ 5,000 and Bills Receivable drawn during the year

were ₹ 25,000. Find the balance of Debtors at th end of the year, assuming that there

were Bad Debts during the year of ₹ 2,000.