Page 12 - HA- SUBJECTIVE - Copy

P. 12

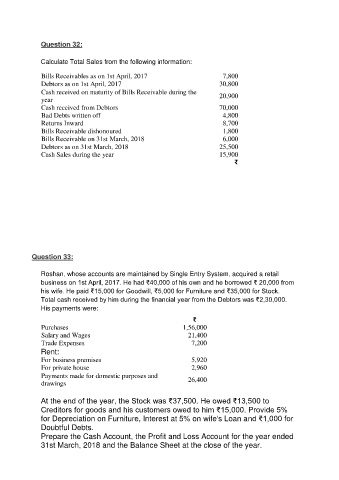

Question 32:

Calculate Total Sales from the following information:

Bills Receivables as on 1st April, 2017 7,800

Debtors as on 1st April, 2017 30,800

Cash received on maturity of Bills Receivable during the 20,900

year

Cash received from Debtors 70,000

Bad Debts written off 4,800

Returns Inward 8,700

Bills Receivable dishonoured 1,800

Bills Receivable on 31st March, 2018 6,000

Debtors as on 31st March, 2018 25,500

Cash Sales during the year 15,900

₹

Question 33:

Roshan, whose accounts are maintained by Single Entry System, acquired a retail

business on 1st April, 2017. He had ₹40,000 of his own and he borrowed ₹ 20,000 from

his wife. He paid ₹15,000 for Goodwill, ₹5,000 for Furniture and ₹35,000 for Stock.

Total cash received by him during the financial year from the Debtors was ₹2,30,000.

His payments were:

₹

Purchases 1,56,000

Salary and Wages 21,400

Trade Expenses 7,200

Rent:

For business premises 5,920

For private house 2,960

Payments made for domestic purposes and

drawings 26,400

At the end of the year, the Stock was ₹37,500. He owed ₹13,500 to

Creditors for goods and his customers owed to him ₹15,000. Provide 5%

for Depreciation on Furniture, Interest at 5% on wife's Loan and ₹1,000 for

Doubtful Debts.

Prepare the Cash Account, the Profit and Loss Account for the year ended

31st March, 2018 and the Balance Sheet at the close of the year.