Page 13 - HA- SUBJECTIVE - Copy

P. 13

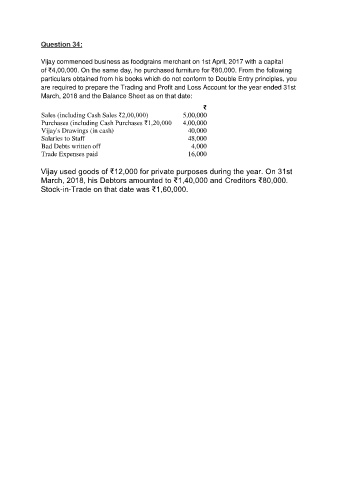

Question 34:

Vijay commenced business as foodgrains merchant on 1st April, 2017 with a capital

of ₹4,00,000. On the same day, he purchased furniture for ₹80,000. From the following

particulars obtained from his books which do not conform to Double Entry principles, you

are required to prepare the Trading and Profit and Loss Account for the year ended 31st

March, 2018 and the Balance Sheet as on that date:

₹

Sales (including Cash Sales ₹2,00,000) 5,00,000

Purchases (including Cash Purchases ₹1,20,000 4,00,000

Vijay's Drawings (in cash) 40,000

Salaries to Staff 48,000

Bad Debts written off 4,000

Trade Expenses paid 16,000

Vijay used goods of ₹12,000 for private purposes during the year. On 31st

March, 2018, his Debtors amounted to ₹1,40,000 and Creditors ₹80,000.

Stock-in-Trade on that date was ₹1,60,000.