Page 3 - HA- SUBJECTIVE - Copy

P. 3

Question 9:

Ram Prashad keeps his books on Single Entry System and from them and the

particulars supplied, the following figures were gathered together on 31 March, 2018

st

Book Debts ₹ 10,000; Cash in Hand ₹ 510; Stock-in-Trade (estimated) ₹ 6,000; Furniture

and Fittings ₹ 1,200; Trade Creditors ₹ 4,000; Bank Overdraft ₹ 1,000; Ram Prashad

stated that he started business on 1 April with cash ₹ 6000 paid into bank but stocks

st

valued at ₹ 4,000. During the year he estimated his drawings to be ₹ 2,400. You are

required to prepare the statement, showing the profit for the year, after writing off 10% for

Depreciation on Furniture and Fittings.

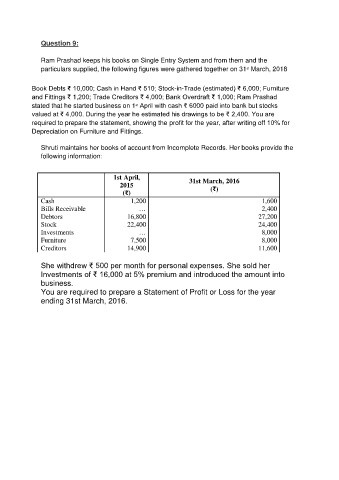

Shruti maintains her books of account from Incomplete Records. Her books provide the

following information:

1st April, 31st March, 2016

2015 (₹)

(₹)

Cash 1,200 1,600

Bills Receivable … 2,400

Debtors 16,800 27,200

Stock 22,400 24,400

Investments … 8,000

Furniture 7,500 8,000

Creditors 14,900 11,600

She withdrew ₹ 500 per month for personal expenses. She sold her

Investments of ₹ 16,000 at 5% premium and introduced the amount into

business.

You are required to prepare a Statement of Profit or Loss for the year

ending 31st March, 2016.