Page 7 - L N (change in psr)

P. 7

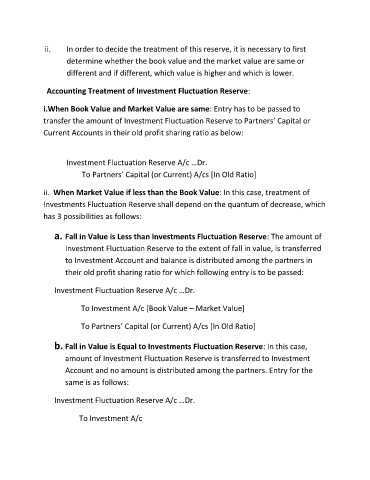

ii. In order to decide the treatment of this reserve, it is necessary to first

determine whether the book value and the market value are same or

different and if different, which value is higher and which is lower.

Accounting Treatment of Investment Fluctuation Reserve:

i.When Book Value and Market Value are same: Entry has to be passed to

transfer the amount of Investment Fluctuation Reserve to Partners’ Capital or

Current Accounts in their old profit sharing ratio as below:

Investment Fluctuation Reserve A/c …Dr.

To Partners’ Capital (or Current) A/cs *In Old Ratio+

ii. When Market Value if less than the Book Value: In this case, treatment of

Investments Fluctuation Reserve shall depend on the quantum of decrease, which

has 3 possibilities as follows:

a. Fall in Value is Less than Investments Fluctuation Reserve: The amount of

Investment Fluctuation Reserve to the extent of fall in value, is transferred

to Investment Account and balance is distributed among the partners in

their old profit sharing ratio for which following entry is to be passed:

Investment Fluctuation Reserve A/c …Dr.

To Investment A/c [Book Value – Market Value]

To Partners’ Capital (or Current) A/cs *In Old Ratio+

b. Fall in Value is Equal to Investments Fluctuation Reserve: In this case,

amount of Investment Fluctuation Reserve is transferred to Investment

Account and no amount is distributed among the partners. Entry for the

same is as follows:

Investment Fluctuation Reserve A/c …Dr.

To Investment A/c