Page 2 - L4

P. 2

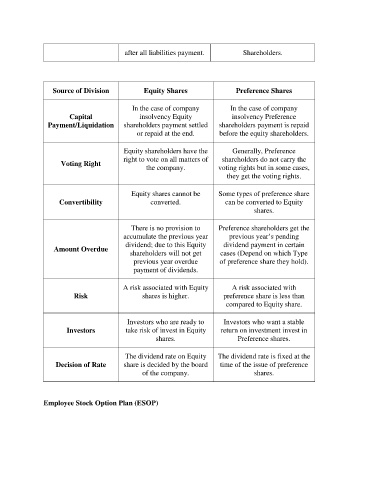

after all liabilities payment. Shareholders.

Source of Division Equity Shares Preference Shares

In the case of company In the case of company

Capital insolvency Equity insolvency Preference

Payment/Liquidation shareholders payment settled shareholders payment is repaid

or repaid at the end. before the equity shareholders.

Equity shareholders have the Generally, Preference

right to vote on all matters of shareholders do not carry the

Voting Right

the company. voting rights but in some cases,

they get the voting rights.

Equity shares cannot be Some types of preference share

Convertibility converted. can be converted to Equity

shares.

There is no provision to Preference shareholders get the

accumulate the previous year previous year’s pending

dividend; due to this Equity dividend payment in certain

Amount Overdue

shareholders will not get cases (Depend on which Type

previous year overdue of preference share they hold).

payment of dividends.

A risk associated with Equity A risk associated with

Risk shares is higher. preference share is less than

compared to Equity share.

Investors who are ready to Investors who want a stable

Investors take risk of invest in Equity return on investment invest in

shares. Preference shares.

The dividend rate on Equity The dividend rate is fixed at the

Decision of Rate share is decided by the board time of the issue of preference

of the company. shares.

Employee Stock Option Plan (ESOP)