Page 1 - L4

P. 1

SAI INTERNATIONAL SCHOOL

CLASS-XI

Sub: Business Studies

Chapter 7: Sources of Business Finance

Topic: Types of Preference Shares & ESOP

(LESSON NOTES- 32)

TYPES OF PREFERENCE SHARES

1. Cumulative and Non-Cumulative: The preference shares which enjoy the right to

accumulate unpaid dividends in the future years, in case the same is not paid during a year are

known as cumulative preference shares. On the other hand, on non-cumulative shares, dividend

is not accumulated if it is not paid in a particular year.

2. Participating and Non-Participating: Preference shares which have a right to participate in

the further surplus of a company shares which after dividend at a certain rate has been paid on

equity shares are called participating preference shares. The non-participating preferences are

such which do not enjoy such rights of participation in the profits of the company.

3. Convertible and Non-Convertible: Preference shares that can be converted into equity

shares within a specified period of time are known as convertible preference shares. On the other

hand, non-convertible shares are such that cannot be converted into equity shares.

4. Redeemable Preference Shares and Irredeemable Preference Shares: Redeemable

Preference Shares are those Preference Shares which are redeemed by the company at a specific

time (not exceeding 20 years from the date of issue) for the repayment or earlier. We call this

repayment of the amount as Redemption. The amount returned by the company at the time of

wind up to the holders of such shares is called Irredeemable Preference Shares.

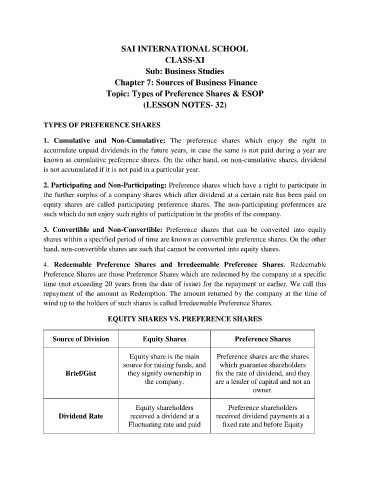

EQUITY SHARES VS. PREFERENCE SHARES

Source of Division Equity Shares Preference Shares

Equity share is the main Preference shares are the shares

source for raising funds, and which guarantee shareholders

Brief/Gist they signify ownership in fix the rate of dividend, and they

the company. are a lender of capital and not an

owner.

Equity shareholders Preference shareholders

Dividend Rate received a dividend at a received dividend payments at a

Fluctuating rate and paid fixed rate and before Equity