Page 3 - HA

P. 3

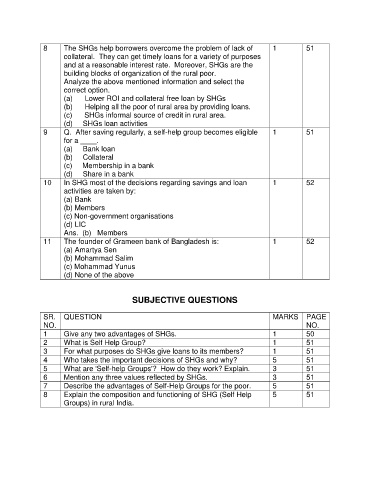

8 The SHGs help borrowers overcome the problem of lack of 1 51

collateral. They can get timely loans for a variety of purposes

and at a reasonable interest rate. Moreover, SHGs are the

building blocks of organization of the rural poor.

Analyze the above mentioned information and select the

correct option.

(a) Lower ROI and collateral free loan by SHGs

(b) Helping all the poor of rural area by providing loans.

(c) SHGs informal source of credit in rural area.

(d) SHGs loan activities

9 Q. After saving regularly, a self-help group becomes eligible 1 51

for a ____.

(a) Bank loan

(b) Collateral

(c) Membership in a bank

(d) Share in a bank

10 In SHG most of the decisions regarding savings and loan 1 52

activities are taken by:

(a) Bank

(b) Members

(c) Non-government organisations

(d) LIC

Ans. (b) Members

11 The founder of Grameen bank of Bangladesh is: 1 52

(a) Amartya Sen

(b) Mohammad Salim

(c) Mohammad Yunus

(d) None of the above

SUBJECTIVE QUESTIONS

SR. QUESTION MARKS PAGE

NO. NO.

1 Give any two advantages of SHGs. 1 50

2 What is Self Help Group? 1 51

3 For what purposes do SHGs give loans to its members? 1 51

4 Who takes the important decisions of SHGs and why? 5 51

5 What are 'Self-help Groups'? How do they work? Explain. 3 51

6 Mention any three values reflected by SHGs. 3 51

7 Describe the advantages of Self-Help Groups for the poor. 5 51

8 Explain the composition and functioning of SHG (Self Help 5 51

Groups) in rural India.