Page 2 - HA

P. 2

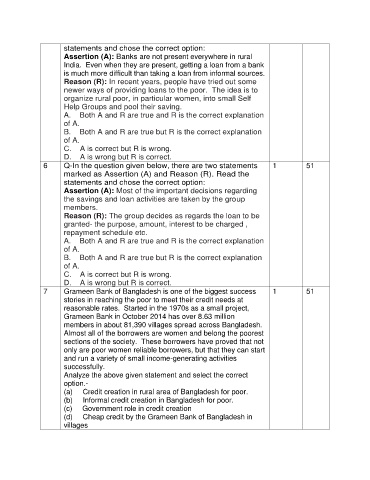

statements and chose the correct option:

Assertion (A): Banks are not present everywhere in rural

India. Even when they are present, getting a loan from a bank

is much more difficult than taking a loan from informal sources.

Reason (R): In recent years, people have tried out some

newer ways of providing loans to the poor. The idea is to

organize rural poor, in particular women, into small Self

Help Groups and pool their saving.

A. Both A and R are true and R is the correct explanation

of A.

B. Both A and R are true but R is the correct explanation

of A.

C. A is correct but R is wrong.

D. A is wrong but R is correct.

6 Q-In the question given below, there are two statements 1 51

marked as Assertion (A) and Reason (R). Read the

statements and chose the correct option:

Assertion (A): Most of the important decisions regarding

the savings and loan activities are taken by the group

members.

Reason (R): The group decides as regards the loan to be

granted- the purpose, amount, interest to be charged ,

repayment schedule etc.

A. Both A and R are true and R is the correct explanation

of A.

B. Both A and R are true but R is the correct explanation

of A.

C. A is correct but R is wrong.

D. A is wrong but R is correct.

7 Grameen Bank of Bangladesh is one of the biggest success 1 51

stories in reaching the poor to meet their credit needs at

reasonable rates. Started in the 1970s as a small project,

Grameen Bank in October 2014 has over 8.63 million

members in about 81,390 villages spread across Bangladesh.

Almost all of the borrowers are women and belong the poorest

sections of the society. These borrowers have proved that not

only are poor women reliable borrowers, but that they can start

and run a variety of small income-generating activities

successfully.

Analyze the above given statement and select the correct

option.-

(a) Credit creation in rural area of Bangladesh for poor.

(b) Informal credit creation in Bangladesh for poor.

(c) Government role in credit creation

(d) Cheap credit by the Grameen Bank of Bangladesh in

villages