Page 1 - LN ISSUE OF DEB

P. 1

CLASS XII

ACCOUNTANCY

LEARNING NOTES – ISSUE OF DEBENTURES

Debentures: The word ‘Debenture’ is used to signify the

acknowledgement of a debt, given under the seal of the company and

containing a contract for the repayment of the principal sum at a specified

date and for the payment of interest (usually half yearly) at a fixed rate

until the principal sum is repaid and it may or may not give a charge on

the assets of the company as security for the loan.

Section 2 (12) of the Companies Act states that "a debenture includes

debenture stock, bonds and any other securities of a company, whether

constituting a charge on the assets of the company or not".

Meaning of Bond

Bonds and debentures are same, both in terms of contents and texture.

In the earlier days, Bonds had been issued by the government, but these

days bonds are also being issued by the Government, Semi-government

and non-government organizations as an acknowledgment of debt.

Zero Coupon Bonds

Zero Coupon Bonds are issued at a discount and redeemed at par. No

interest payment is made on such bonds at periodic intervals before

maturity.

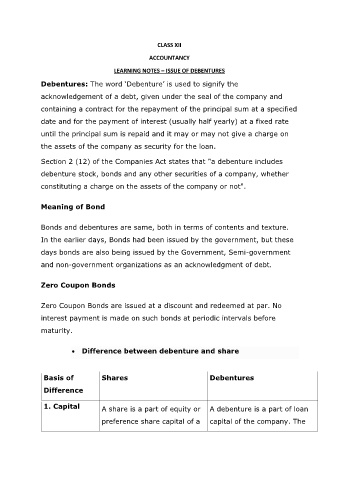

• Difference between debenture and share

Basis of Shares Debentures

Difference

1. Capital A share is a part of equity or A debenture is a part of loan

preference share capital of a capital of the company. The