Page 5 - LM DEATH OF A PARTNER

P. 5

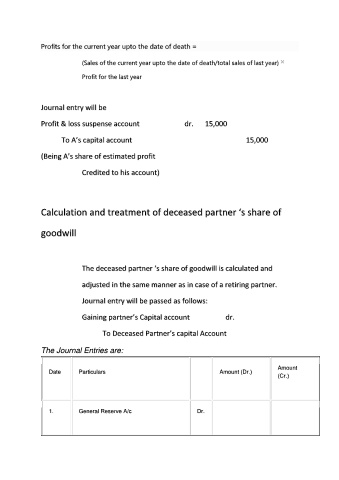

Profits for the current year upto the date of death =

(Sales of the current year upto the date of death/total sales of last year)

Profit for the last year

Journal entry will be

Profit & loss suspense account dr. 15,000

To A’s capital account 15,000

(Being A’s share of estimated profit

Credited to his account)

Calculation and treatment of deceased partner ‘s share of

goodwill

The deceased partner ‘s share of goodwill is calculated and

adjusted in the same manner as in case of a retiring partner.

Journal entry will be passed as follows:

Gaining partner’s Capital account dr.

To Deceased Partner’s capital Account

The Journal Entries are:

Amount

Date Particulars Amount (Dr.)

(Cr.)

1. General Reserve A/c Dr.