Page 4 - LM DEATH OF A PARTNER

P. 4

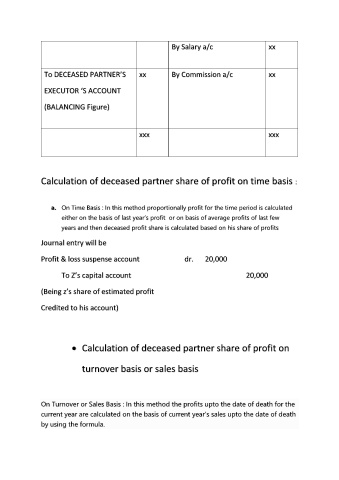

By Salary a/c xx

To DECEASED PARTNER’S xx By Commission a/c xx

EXECUTOR ‘S ACCOUNT

(BALANCING Figure)

xxx xxx

Calculation of deceased partner share of profit on time basis :

a. On Time Basis : In this method proportionally profit for the time period is calculated

either on the basis of last year’s profit or on basis of average profits of last few

years and then deceased profit share is calculated based on his share of profits

Journal entry will be

Profit & loss suspense account dr. 20,000

To Z’s capital account 20,000

(Being z’s share of estimated profit

Credited to his account)

• Calculation of deceased partner share of profit on

turnover basis or sales basis

On Turnover or Sales Basis : In this method the profits upto the date of death for the

current year are calculated on the basis of current year’s sales upto the date of death

by using the formula.