Page 5 - Lesson Note 1

P. 5

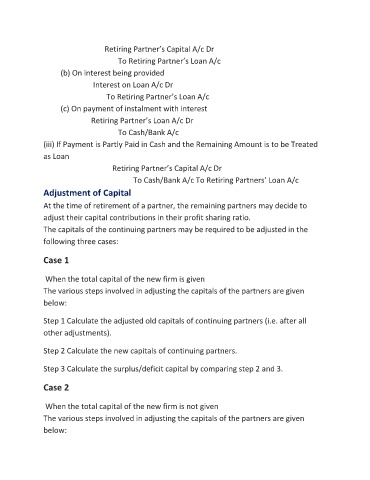

Retiring Partner’s Capital A/c Dr

To Retiring Partner’s Loan A/c

(b) On interest being provided

Interest on Loan A/c Dr

To Retiring Partner’s Loan A/c

(c) On payment of instalment with interest

Retiring Partner’s Loan A/c Dr

To Cash/Bank A/c

(iii) If Payment is Partly Paid in Cash and the Remaining Amount is to be Treated

as Loan

Retiring Partner’s Capital A/c Dr

To Cash/Bank A/c To Retiring Partners’ Loan A/c

Adjustment of Capital

At the time of retirement of a partner, the remaining partners may decide to

adjust their capital contributions in their profit sharing ratio.

The capitals of the continuing partners may be required to be adjusted in the

following three cases:

Case 1

When the total capital of the new firm is given

The various steps involved in adjusting the capitals of the partners are given

below:

Step 1 Calculate the adjusted old capitals of continuing partners (i.e. after all

other adjustments).

Step 2 Calculate the new capitals of continuing partners.

Step 3 Calculate the surplus/deficit capital by comparing step 2 and 3.

Case 2

When the total capital of the new firm is not given

The various steps involved in adjusting the capitals of the partners are given

below: