Page 3 - Lesson Note 1

P. 3

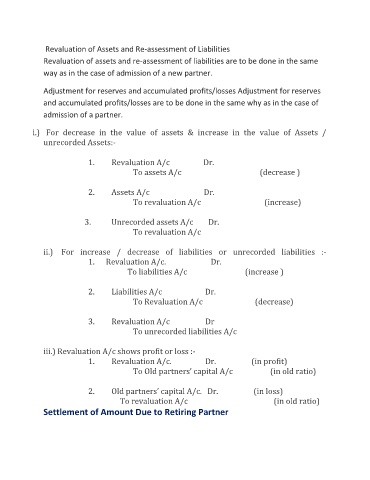

Revaluation of Assets and Re-assessment of Liabilities

Revaluation of assets and re-assessment of liabilities are to be done in the same

way as in the case of admission of a new partner.

Adjustment for reserves and accumulated profits/losses Adjustment for reserves

and accumulated profits/losses are to be done in the same why as in the case of

admission of a partner.

i.) For decrease in the value of assets & increase in the value of Assets /

unrecorded Assets:-

1. Revaluation A/c Dr.

To assets A/c (decrease )

2. Assets A/c Dr.

To revaluation A/c (increase)

3. Unrecorded assets A/c Dr.

To revaluation A/c

ii.) For increase / decrease of liabilities or unrecorded liabilities :-

1. Revaluation A/c. Dr.

To liabilities A/c (increase )

2. Liabilities A/c Dr.

To Revaluation A/c (decrease)

3. Revaluation A/c Dr

To unrecorded liabilities A/c

iii.) Revaluation A/c shows profit or loss :-

1. Revaluation A/c. Dr. (in profit)

To Old partners’ capital A/c (in old ratio)

2. Old partners’ capital A/c. Dr. (in loss)

To revaluation A/c (in old ratio)

Settlement of Amount Due to Retiring Partner