Page 2 - LN

P. 2

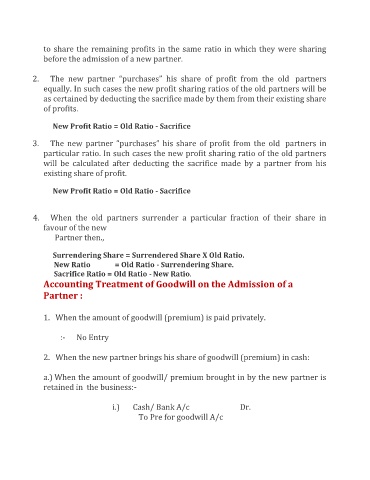

to share the remaining profits in the same ratio in which they were sharing

before the admission of a new partner.

2. The new partner “purchases” his share of profit from the old partners

equally. In such cases the new profit sharing ratios of the old partners will be

as certained by deducting the sacrifice made by them from their existing share

of profits.

New Profit Ratio = Old Ratio - Sacrifice

3. The new partner “purchases” his share of profit from the old partners in

particular ratio. In such cases the new profit sharing ratio of the old partners

will be calculated after deducting the sacrifice made by a partner from his

existing share of profit.

New Profit Ratio = Old Ratio - Sacrifice

4. When the old partners surrender a particular fraction of their share in

favour of the new

Partner then.,

Surrendering Share = Surrendered Share X Old Ratio.

New Ratio = Old Ratio - Surrendering Share.

Sacrifice Ratio = Old Ratio - New Ratio.

Accounting Treatment of Goodwill on the Admission of a

Partner :

1. When the amount of goodwill (premium) is paid privately.

:- No Entry

2. When the new partner brings his share of goodwill (premium) in cash:

a.) When the amount of goodwill/ premium brought in by the new partner is

retained in the business:-

i.) Cash/ Bank A/c Dr.

To Pre for goodwill A/c