Page 2 - LESSON NOTE

P. 2

General Reserve :

If the purpose of creating the reserve is to meet any unforeseen contingency

(Liability which is not known) in future, the reserve is called 'General Reserve'.

These are retained for strengthening the financial position of the enterprise.

Specific Reserve :

Specific reserves are those reserves which are created for a specific purpose

and can be utilized only for that purposed. 'Dividend Equalization Reserve' and

'Reserve for Replacement of Asset' are the examples of Specific Reserve.

Capital Reserve :

In addition to the normal profits, capital profits are also earned in the business

from many sources. Reserves created out of capital profits which are.

1. Not of recurring nature

2. Not readily available for distribution as dividend among the

shareholders.

3. These reserve can be utilized for writing off capital losses.

Capital Reserves may be created out of such profits as :

i. Profit on sale of any fixed asset.

ii. Profit on revaluation of assets.

iii. Profit from forfeiture of shares,

iv. Profit prior to incorporation of company.

Secret Reserve :

A secret reserve is created by undervaluing the fixed assets. Existence of secret

reserve

1. Reduce the profits of the business enterprise and

2. Reduces its tax liability.

3. Secret reserve is secret in the sense that it is not known to the outsiders.

4. such reserves are created by showing the assets at a lower amount and

liabilities at a higher amount.

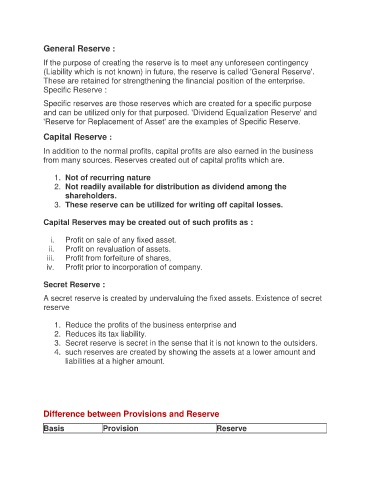

Difference between Provisions and Reserve

Basis Provision Reserve