Page 2 - Home Assignment 2

P. 2

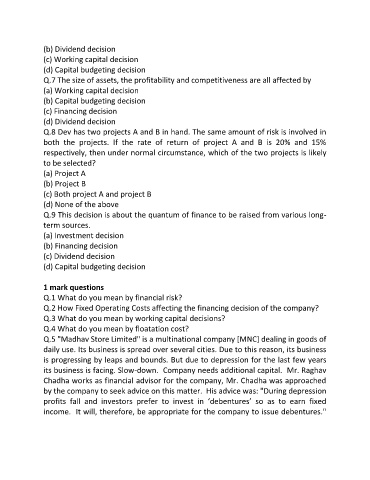

(b) Dividend decision

(c) Working capital decision

(d) Capital budgeting decision

Q.7 The size of assets, the profitability and competitiveness are all affected by

(a) Working capital decision

(b) Capital budgeting decision

(c) Financing decision

(d) Dividend decision

Q.8 Dev has two projects A and B in hand. The same amount of risk is involved in

both the projects. If the rate of return of project A and B is 20% and 15%

respectively, then under normal circumstance, which of the two projects is likely

to be selected?

(a) Project A

(b) Project B

(c) Both project A and project B

(d) None of the above

Q.9 This decision is about the quantum of finance to be raised from various long-

term sources.

(a) Investment decision

(b) Financing decision

(c) Dividend decision

(d) Capital budgeting decision

1 mark questions

Q.1 What do you mean by financial risk?

Q.2 How Fixed Operating Costs affecting the financing decision of the company?

Q.3 What do you mean by working capital decisions?

Q.4 What do you mean by floatation cost?

Q.5 "Madhav Store Limited" is a multinational company [MNC] dealing in goods of

daily use. Its business is spread over several cities. Due to this reason, its business

is progressing by leaps and bounds. But due to depression for the last few years

its business is facing. Slow-down. Company needs additional capital. Mr. Raghav

Chadha works as financial advisor for the company, Mr. Chadha was approached

by the company to seek advice on this matter. His advice was: "During depression

profits fall and investors prefer to invest in ‘debentures’ so as to earn fixed

income. It will, therefore, be appropriate for the company to issue debentures."