Page 2 - L6

P. 2

Advantages of Borrowed Funds:

The advantages of borrowed funds are as follows:

a) The interest paid on borrowed capital is a tax- deductible expense.

b) Borrowed funds do not lead to the dilution of control as they do not provide voting rights.

c) Borrowed funds provide flexibility in the capital structure of the company as they can be

redeemed as and when required.

Disadvantages of Borrowed Funds:

The disadvantages of borrowed funds are as follows:

a) Borrowed funds create fixed financial funds on the business organisation.

b) Borrowed funds increase financial risk.

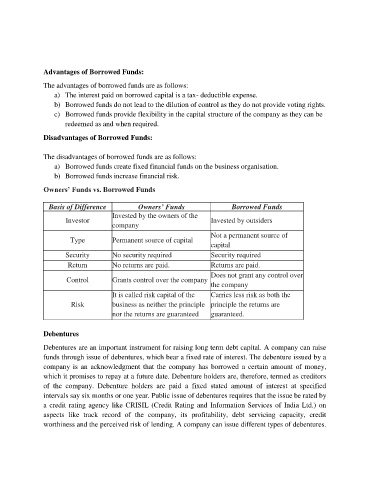

Owners’ Funds vs. Borrowed Funds

Basis of Difference Owners’ Funds Borrowed Funds

Invested by the owners of the

Investor Invested by outsiders

company

Not a permanent source of

Type Permanent source of capital

capital

Security No security required Security required

Return No returns are paid. Returns are paid.

Does not grant any control over

Control Grants control over the company

the company

It is called risk capital of the Carries less risk as both the

Risk business as neither the principle principle the returns are

nor the returns are guaranteed guaranteed.

Debentures

Debentures are an important instrument for raising long term debt capital. A company can raise

funds through issue of debentures, which bear a fixed rate of interest. The debenture issued by a

company is an acknowledgment that the company has borrowed a certain amount of money,

which it promises to repay at a future date. Debenture holders are, therefore, termed as creditors

of the company. Debenture holders are paid a fixed stated amount of interest at specified

intervals say six months or one year. Public issue of debentures requires that the issue be rated by

a credit rating agency like CRISIL (Credit Rating and Information Services of India Ltd.) on

aspects like track record of the company, its profitability, debt servicing capacity, credit

worthiness and the perceived risk of lending. A company can issue different types of debentures.