Page 1 - L2

P. 1

SAI INTERNATIONAL SCHOOL

CLASS-XI

SUB: BUSINESS STUDIES

Chapter 4: BUSINESS SERVICES

Lesson Notes 17 BANKING SERVICES

Banking services:

Commercial banks are an important institution of the economy for providing institutional credit

to its customers. A banking company in India is the one which transacts the business of banking

which means accepting, for the purpose of lending and investment of deposits of money from the

public, repayable on demand or otherwise and withdrawable by cheques, draft, and order or

otherwise. In simple terms, a bank accepts money on deposits, repayable on demand and also

earns a margin of profit by lending money. A bank stimulates economic activity in the market by

dealing in money. It mobilises the savings of people and makes funds available to business

financing their capital and revenue expenditure. It also deals in financial instruments and

provides financial services for a price i.e., interest, discount, commission, etc.

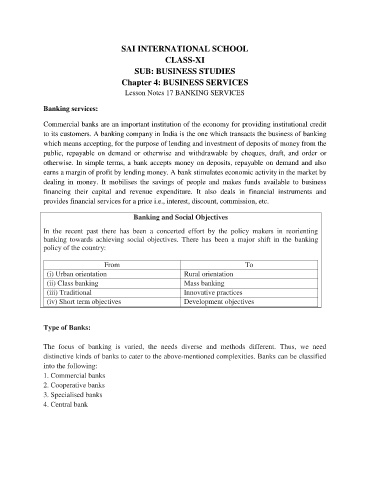

Banking and Social Objectives

In the recent past there has been a concerted effort by the policy makers in reorienting

banking towards achieving social objectives. There has been a major shift in the banking

policy of the country:

From To

(i) Urban orientation Rural orientation

(ii) Class banking Mass banking

(iii) Traditional Innovative practices

(iv) Short term objectives Development objectives

Type of Banks:

The focus of banking is varied, the needs diverse and methods different. Thus, we need

distinctive kinds of banks to cater to the above-mentioned complexities. Banks can be classified

into the following:

1. Commercial banks

2. Cooperative banks

3. Specialised banks

4. Central bank