Page 1 - LN

P. 1

SAI INTERNATIONAL SCHOOL, BHUBANESWAR.

Class X: SOCIAL STUDIES – ECONOMICS

CHAPTER – 3 - MONEY AND CREDIT (PAGE NO. 48 & 49)

LESSON NOTES

NOTES-

FORMAL SECTOR CREDIT IN INDIA

1. The various types of loans can be conveniently grouped as formal sector loans

and informal sector loans.

2. Among the formal are loans from banks and cooperatives.

3. The informal lenders include moneylenders, traders, employers, relatives and

friends, etc.

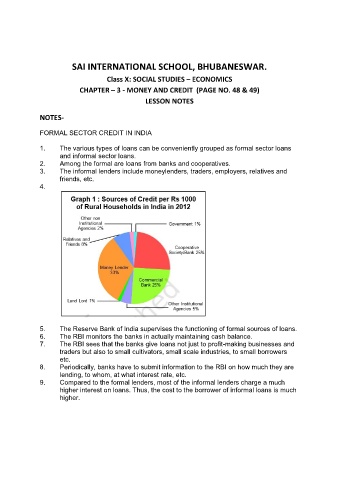

4.

5. The Reserve Bank of India supervises the functioning of formal sources of loans.

6. The RBI monitors the banks in actually maintaining cash balance.

7. The RBI sees that the banks give loans not just to profit-making businesses and

traders but also to small cultivators, small scale industries, to small borrowers

etc.

8. Periodically, banks have to submit information to the RBI on how much they are

lending, to whom, at what interest rate, etc.

9. Compared to the formal lenders, most of the informal lenders charge a much

higher interest on loans. Thus, the cost to the borrower of informal loans is much

higher.