Page 2 - 5HA

P. 2

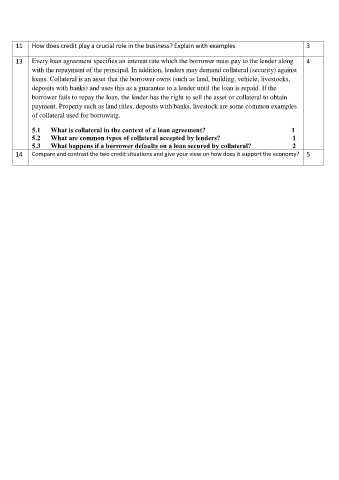

11 How does credit play a crucial role in the business? Explain with examples 3

13 Every loan agreement specifies an interest rate which the borrower must pay to the lender along 4

with the repayment of the principal. In addition, lenders may demand collateral (security) against

loans. Collateral is an asset that the borrower owns (such as land, building, vehicle, livestocks,

deposits with banks) and uses this as a guarantee to a lender until the loan is repaid. If the

borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain

payment. Property such as land titles, deposits with banks, livestock are some common examples

of collateral used for borrowing.

5.1 What is collateral in the context of a loan agreement? 1

5.2 What are common types of collateral accepted by lenders? 1

5.3 What happens if a borrower defaults on a loan secured by collateral? 2

14 Compare and contrast the two credit situations and give your view on how does it support the economy? 5