Page 2 - LN

P. 2

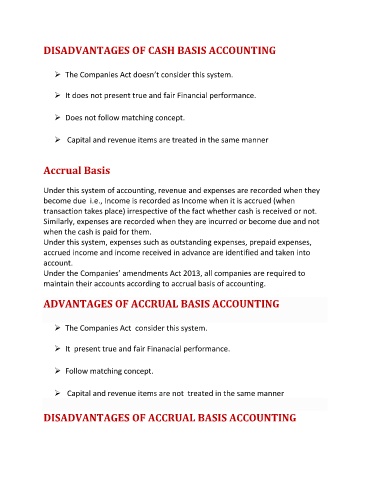

DISADVANTAGES OF CASH BASIS ACCOUNTING

The Companies Act doesn’t consider this system.

It does not present true and fair Financial performance.

Does not follow matching concept.

Capital and revenue items are treated in the same manner

Accrual Basis

Under this system of accounting, revenue and expenses are recorded when they

become due i.e., Income is recorded as Income when it is accrued (when

transaction takes place) irrespective of the fact whether cash is received or not.

Similarly, expenses are recorded when they are incurred or become due and not

when the cash is paid for them.

Under this system, expenses such as outstanding expenses, prepaid expenses,

accrued income and income received in advance are identified and taken into

account.

Under the Companies’ amendments Act 2013, all companies are required to

maintain their accounts according to accrual basis of accounting.

ADVANTAGES OF ACCRUAL BASIS ACCOUNTING

The Companies Act consider this system.

It present true and fair Finanacial performance.

Follow matching concept.

Capital and revenue items are not treated in the same manner

DISADVANTAGES OF ACCRUAL BASIS ACCOUNTING