Page 3 - LN

P. 3

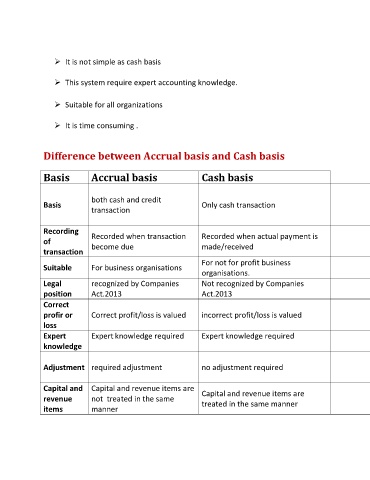

It is not simple as cash basis

This system require expert accounting knowledge.

Suitable for all organizations

It is time consuming .

Difference between Accrual basis and Cash basis

Basis Accrual basis Cash basis

In accrual accounting, incomes and

both cash and credit expenses are recognized when

Basis Only cash transaction

transaction they are done (on the mercantile

basis).

Recording Recorded when transaction Recorded when actual payment is

of become due made/received All expenses and all incomes.

transaction

For not for profit business Complex and difficult to

Suitable For business organisations

organisations. understand.

Legal recognized by Companies Not recognized by Companies

Recognized by Companies Act.

position Act.2013 Act.2013

Correct

When revenue is earned or loss is

profir or Correct profit/loss is valued incorrect profit/loss is valued

incurred.

loss

Expert Expert knowledge required Expert knowledge required Revenue/Expense/Profit/Loss.

knowledge

We can understand how much

Adjustment required adjustment no adjustment required profit or loss a business has made

during a particular period.

Capital and Capital and revenue items are

Capital and revenue items are Yes, because it includes all of the

revenue not treated in the same

treated in the same manner transactions.

items manner