Page 2 - HA

P. 2

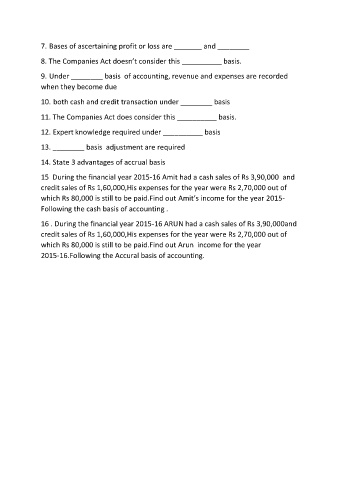

7. Bases of ascertaining profit or loss are _______ and ________

8. The Companies Act doesn’t consider this __________ basis.

9. Under ________ basis of accounting, revenue and expenses are recorded

when they become due

10. both cash and credit transaction under ________ basis

11. The Companies Act does consider this __________ basis.

12. Expert knowledge required under __________ basis

13. ________ basis adjustment are required

14. State 3 advantages of accrual basis

15 During the financial year 2015-16 Amit had a cash sales of Rs 3,90,000 and

credit sales of Rs 1,60,000,His expenses for the year were Rs 2,70,000 out of

which Rs 80,000 is still to be paid.Find out Amit’s income for the year 2015-

Following the cash basis of accounting .

16 . During the financial year 2015-16 ARUN had a cash sales of Rs 3,90,000and

credit sales of Rs 1,60,000,His expenses for the year were Rs 2,70,000 out of

which Rs 80,000 is still to be paid.Find out Arun income for the year

2015-16.Following the Accural basis of accounting.