Page 2 - Lesson Note

P. 2

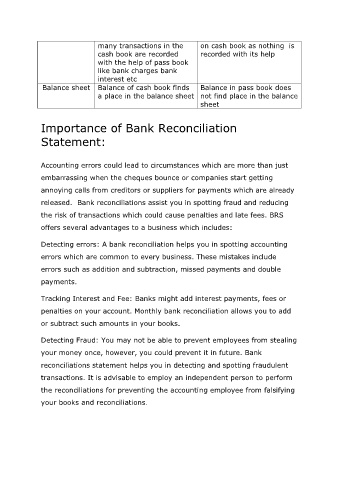

many transactions in the on cash book as nothing is

cash book are recorded recorded with its help

with the help of pass book

like bank charges bank

interest etc

Balance sheet Balance of cash book finds Balance in pass book does

a place in the balance sheet not find place in the balance

sheet

Importance of Bank Reconciliation

Statement:

Accounting errors could lead to circumstances which are more than just

embarrassing when the cheques bounce or companies start getting

annoying calls from creditors or suppliers for payments which are already

released. Bank reconciliations assist you in spotting fraud and reducing

the risk of transactions which could cause penalties and late fees. BRS

offers several advantages to a business which includes:

Detecting errors: A bank reconciliation helps you in spotting accounting

errors which are common to every business. These mistakes include

errors such as addition and subtraction, missed payments and double

payments.

Tracking Interest and Fee: Banks might add interest payments, fees or

penalties on your account. Monthly bank reconciliation allows you to add

or subtract such amounts in your books.

Detecting Fraud: You may not be able to prevent employees from stealing

your money once, however, you could prevent it in future. Bank

reconciliations statement helps you in detecting and spotting fraudulent

transactions. It is advisable to employ an independent person to perform

the reconciliations for preventing the accounting employee from falsifying

your books and reconciliations.