Page 6 - HA ISSUE OF DEB

P. 6

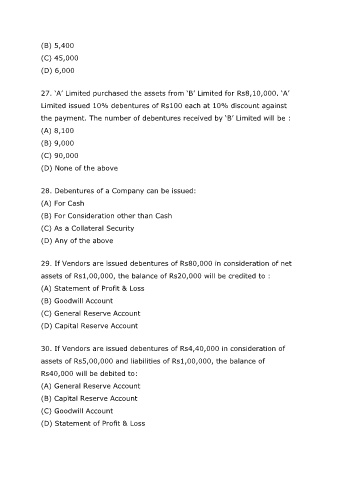

(B) 5,400

(C) 45,000

(D) 6,000

27. ‘A’ Limited purchased the assets from ‘B’ Limited for Rs8,10,000. ‘A’

Limited issued 10% debentures of Rs100 each at 10% discount against

the payment. The number of debentures received by ‘B’ Limited will be :

(A) 8,100

(B) 9,000

(C) 90,000

(D) None of the above

28. Debentures of a Company can be issued:

(A) For Cash

(B) For Consideration other than Cash

(C) As a Collateral Security

(D) Any of the above

29. If Vendors are issued debentures of Rs80,000 in consideration of net

assets of Rs1,00,000, the balance of Rs20,000 will be credited to :

(A) Statement of Profit & Loss

(B) Goodwill Account

(C) General Reserve Account

(D) Capital Reserve Account

30. If Vendors are issued debentures of Rs4,40,000 in consideration of

assets of Rs5,00,000 and liabilities of Rs1,00,000, the balance of

Rs40,000 will be debited to:

(A) General Reserve Account

(B) Capital Reserve Account

(C) Goodwill Account

(D) Statement of Profit & Loss