Page 5 - HA1

P. 5

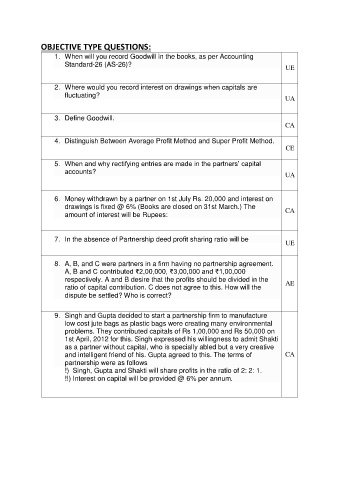

OBJECTIVE TYPE QUESTIONS:

1. When will you record Goodwill in the books, as per Accounting

Standard-26 (AS-26)?

UE

2. Where would you record interest on drawings when capitals are

fluctuating?

UA

3. Define Goodwill.

CA

4. Distinguish Between Average Profit Method and Super Profit Method.

CE

5. When and why rectifying entries are made in the partners’ capital

accounts?

UA

6. Money withdrawn by a partner on 1st July Rs. 20,000 and interest on

drawings is fixed @ 6% (Books are closed on 31st March.) The CA

amount of interest will be Rupees:

7. In the absence of Partnership deed profit sharing ratio will be

UE

8. A, B, and C were partners in a firm having no partnership agreement.

A, B and C contributed ₹2,00,000, ₹3,00,000 and ₹1,00,000

respectively. A and B desire that the profits should be divided in the AE

ratio of capital contribution. C does not agree to this. How will the

dispute be settled? Who is correct?

9. Singh and Gupta decided to start a partnership firm to manufacture

low cost jute bags as plastic bags were creating many environmental

problems. They contributed capitals of Rs 1,00,000 and Rs 50,000 on

1st April, 2012 for this. Singh expressed his willingness to admit Shakti

as a partner without capital, who is specially abled but a very creative

and intelligent friend of his. Gupta agreed to this. The terms of CA

partnership were as follows

!) Singh, Gupta and Shakti will share profits in the ratio of 2: 2: 1.

!!) Interest on capital will be provided @ 6% per annum.