Page 4 - Lesson Note-47 (1)

P. 4

• During excess demand situation the margin requirement is to be

increased, that will result a contraction in credit creation power of

commercial bank and check in money supply into the economy.

• Purchasing power in the economy reduces, aggregate demand

falls and excess demand situation is corrected.

The reverse is true in case of deficient demand

Moral suasion: -

It is a combination of Persuasion and pressure that the central bank

applies to other banks in order to get them fall in line with its policy

• During excess demand situation the central bank should adopt the

dear money policy.

• During Deficient demand situation the central bank should adopt

the cheap money policy.

Selective credit controls: -

It refers to a method in which the central bank gives directions to

other banks to give or not to give credit for certain purposes to

particular sectors. During deficient demand, the central bank

withdraws rationing of credit and make efforts to encourage

credit.

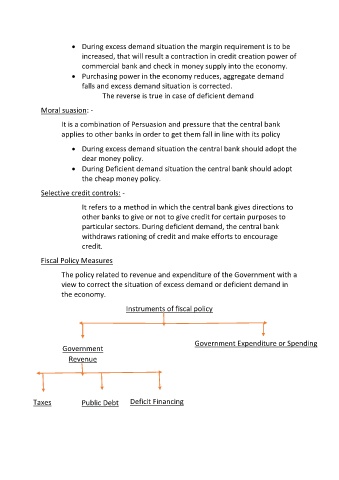

Fiscal Policy Measures

The policy related to revenue and expenditure of the Government with a

view to correct the situation of excess demand or deficient demand in

the economy.

Instruments of fiscal policy

Government Expenditure or Spending

Government

Revenue

Taxes Public Debt Deficit Financing