Page 8 - Lesson Note

P. 8

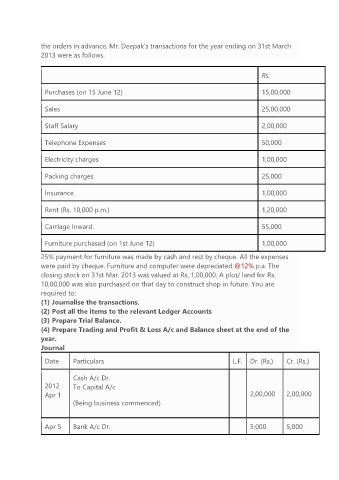

the orders in advance. Mr. Deepak’s transactions for the year ending on 31st March

2013 were as follows.

Rs.

Purchases (on 15 June 12) 15,00,000

Sales 25,00,000

Staff Salary 2,00,000

Telephone Expenses 50,000

Electricity charges 1,00,000

Packing charges 25,000

Insurance 1,00,000

Rent (Rs. 10,000 p.m.) 1,20,000

Carriage Inward. 55,000

Furniture purchased (on 1st June 12) 1,00,000

25% payment for furniture was made by cash and rest by cheque. All the expenses

were paid by cheque. Furniture and computer were depreciated @12% p.a. The

closing stock on 31st Mar. 2013 was valued at Rs. 1,00,000. A plot/ land for Rs.

10,00,000 was also purchased on that day to construct shop in future. You are

required to:

(1) Journalise the transactions.

(2) Post all the items to the relevant Ledger Accounts

(3) Prepare Trial Balance.

(4) Prepare Trading and Profit & Loss A/c and Balance sheet at the end of the

year.

Journal

Date Particulars L.F. Dr. (Rs.) Cr. (Rs.)

Cash A/c Dr.

2012 To Capital A/c

Apr 1 2,00,000 2,00,000

(Being business commenced)

Apr 5 Bank A/c Dr. 5,000 5,000