Page 29 - Chapter-11.pmd

P. 29

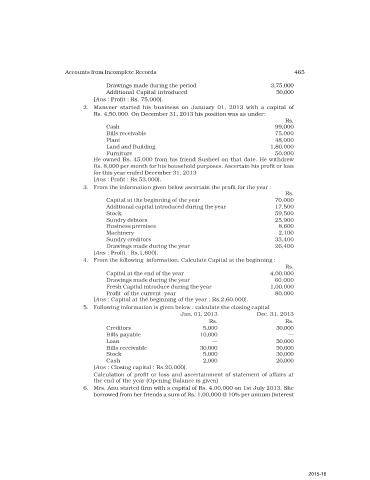

Accounts from Incomplete Records 465

Drawings made during the period 3,75,000

Additional Capital introduced 50,000

[Ans : Profit : Rs. 75,000].

2. Manveer started his business on January 01, 2013 with a capital of

Rs. 4,50,000. On December 31, 2013 his position was as under:

Rs.

Cash 99,000

Bills receivable 75,000

Plant 48,000

Land and Building 1,80,000

Furniture 50,000

He owned Rs. 45,000 from his friend Susheel on that date. He withdrew

Rs. 8,000 per month for his household purposes. Ascertain his profit or loss

for this year ended December 31, 2013

[Ans : Profit : Rs.53,000].

3. From the information given below ascertain the profit for the year :

Rs.

Capital at the beginning of the year 70,000

Additional capital introduced during the year 17,500

Stock 59,500

Sundry debtors 25,900

Business premises 8,600

Machinery 2,100

Sundry creditors 33,400

Drawings made during the year 26,400

[Ans : Profit : Rs.1,600].

4. From the following information, Calculate Capital at the beginning :

Rs.

Capital at the end of the year 4,00,000

Drawings made during the year 60,000

Fresh Capital introduce during the year 1,00,000

Profit of the current year 80,000

[Ans : Capital at thé beginning of the year : Rs.2,60,000].

5. Following information is given below : calculate the closing capital

Jan. 01, 2013 Dec. 31, 2013

Rs. Rs.

Creditors 5,000 30,000

Bills payable 10,000 —

Loan — 50,000

Bills receivable 30,000 50,000

Stock 5,000 30,000

Cash 2,000 20,000

[Ans : Closing capital : Rs.20,000].

Calculation of profit or loss and ascertainment of statement of affairs at

the end of the year (Opening Balance is given)

6. Mrs. Anu started firm with a capital of Rs. 4,00,000 on 1st July 2013. She

borrowed from her friends a sum of Rs. 1,00,000 @ 10% per annum (interest

2015-16