Page 2 - LN

P. 2

Definition of Assets

“ Assets are future economic benefits, the rights, which are owned or controlled by an

organization or individual.” -- Finney and Miller

“ Assets are property or legal right owned by an individual or a company to which money

value can be attached.” -- R. Brockington

According to Institute of Certified Public Accountants, U.S.A ;

“ Current Assets include cash and other assets or resources commonly identified as those which

are reasonably expected to be realized in cash or sold or consumed during the normal operating

cycle of the business.”

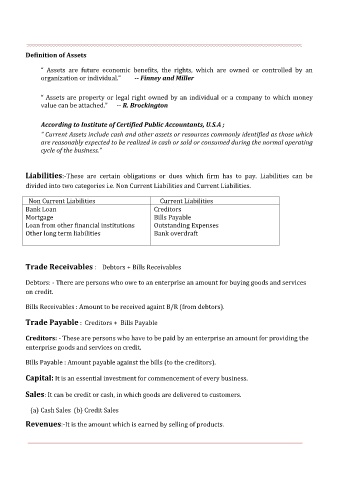

Liabilities:-These are certain obligations or dues which firm has to pay. Liabilities can be

divided into two categories i.e. Non Current Liabilities and Current Liabilities.

Non Current Liabilities Current Liabilities

Bank Loan Creditors

Mortgage Bills Payable

Loan from other financial institutions Outstanding Expenses

Other long term liabilities Bank overdraft

Trade Receivables : Debtors + Bills Receivables

Debtors: - There are persons who owe to an enterprise an amount for buying goods and services

on credit.

Bills Receivables : Amount to be received againt B/R (from debtors).

Trade Payable : Creditors + Bills Payable

Creditors: - These are persons who have to be paid by an enterprise an amount for providing the

enterprise goods and services on credit.

Bills Payable : Amount payable against the bills (to the creditors).

Capital: It is an essential investment for commencement of every business.

Sales: It can be credit or cash, in which goods are delivered to customers.

(a) Cash Sales (b) Credit Sales

Revenues:-It is the amount which is earned by selling of products.