Page 1 - 1

P. 1

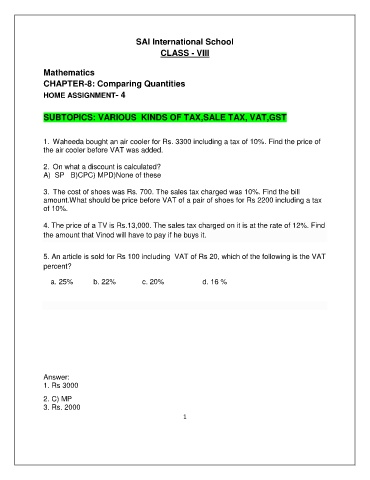

SAI International School

CLASS - VIII

Mathematics

CHAPTER-8: Comparing Quantities

HOME ASSIGNMENT- 4

SUBTOPICS: VARIOUS KINDS OF TAX,SALE TAX, VAT,GST

1. Waheeda bought an air cooler for Rs. 3300 including a tax of 10%. Find the price of

the air cooler before VAT was added.

2. On what a discount is calculated?

A) SP B)CPC) MPD)None of these

3. The cost of shoes was Rs. 700. The sales tax charged was 10%. Find the bill

amount.What should be price before VAT of a pair of shoes for Rs 2200 including a tax

of 10%.

4. The price of a TV is Rs.13,000. The sales tax charged on it is at the rate of 12%. Find

the amount that Vinod will have to pay if he buys it.

5. An article is sold for Rs 100 including VAT of Rs 20, which of the following is the VAT

percent?

a. 25% b. 22% c. 20% d. 16 %

Answer:

1. Rs 3000

2. C) MP

3. Rs. 2000

1