Page 1 - HA 241604010121

P. 1

CH-5: BUSINESS ARITHMETIC

CODE: 241605010116

TOPIC: RETURN ON INVESTMENT AND RETURN ON EQUITY

NOTES:

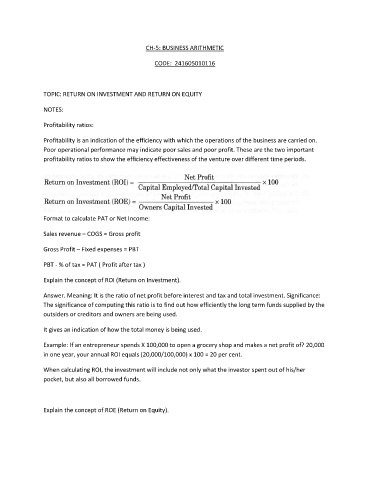

Profitability ratios:

Profitability is an indication of the efficiency with which the operations of the business are carried on.

Poor operational performance may indicate poor sales and poor profit. These are the two important

profitability ratios to show the efficiency effectiveness of the venture over different time periods.

Format to calculate PAT or Net Income:

Sales revenue – COGS = Gross profit

Gross Profit – Fixed expenses = PBT

PBT - % of tax = PAT ( Profit after tax )

Explain the concept of ROI (Return on Investment).

Answer. Meaning: It is the ratio of net profit before interest and tax and total investment. Significance:

The significance of computing this ratio is to find out how efficiently the long term funds supplied by the

outsiders or creditors and owners are being used.

It gives an indication of how the total money is being used.

Example: If an entrepreneur spends X 100,000 to open a grocery shop and makes a net profit of? 20,000

in one year, your annual ROI equals (20,000/100,000) x 100 = 20 per cent.

When calculating ROI, the investment will include not only what the investor spent out of his/her

pocket, but also all borrowed funds.

Explain the concept of ROE (Return on Equity).